Dec 4, 2025

Since our inception, we’ve held the core belief that the use of intelligent and dynamic technology systems will improve both the consumer and agency experience. By utilizing deep learning models trained on client data, consumer behaviors, and macro-economic trends, agencies can identify and engage those consumers with both the desire and ability to repay via the best channel, with the best offer, at the best time.

But you don’t need to hear this from us! A study from Baruch College underscores the importance of implementing an evolving, comprehensive scoring model. In a field experiment, researchers found that using AI models to continuously score and prioritize accounts increased recoveries by 23% while simultaneously reducing total call volume by 8%.

The results underscore a major opportunity for agencies to improve consumer experience and overall performance by implementing dynamic, AI-powered models in their recovery strategy.

The Study

The Experiment

To conduct the experiment, researchers examined a mid-sized collection agency servicing credit card and buy-now-pay-later accounts.

The study randomly divided a new cohort of 7,839 active accounts into two groups. Accounts in the control group were subject to the agency’s standard process, with strategy dictated by a group of collection officers. In the test group, an AI model generated and revised a ranked list every day- identifying target accounts and dictating the priority in which they would be contacted.

The experiment ran for several weeks with agents in both groups using the same scripts and keeping all other parts of the process identical.

How the Model Worked

The researchers exclusively trained the AI model on data available to officers from 36,031 past account interactions, including payment histories, balances, and notes written by collectors after each call. The model identified subtle repayment signals, grouping consumer interactions into themes that reflected financial standing, repayment intent, and borrowers’ awareness of consequences. Using these signals, the model was able to distinguish between borrowers who wanted to pay but needed reminders, those facing genuine hardship, and those unlikely to respond to further outreach.

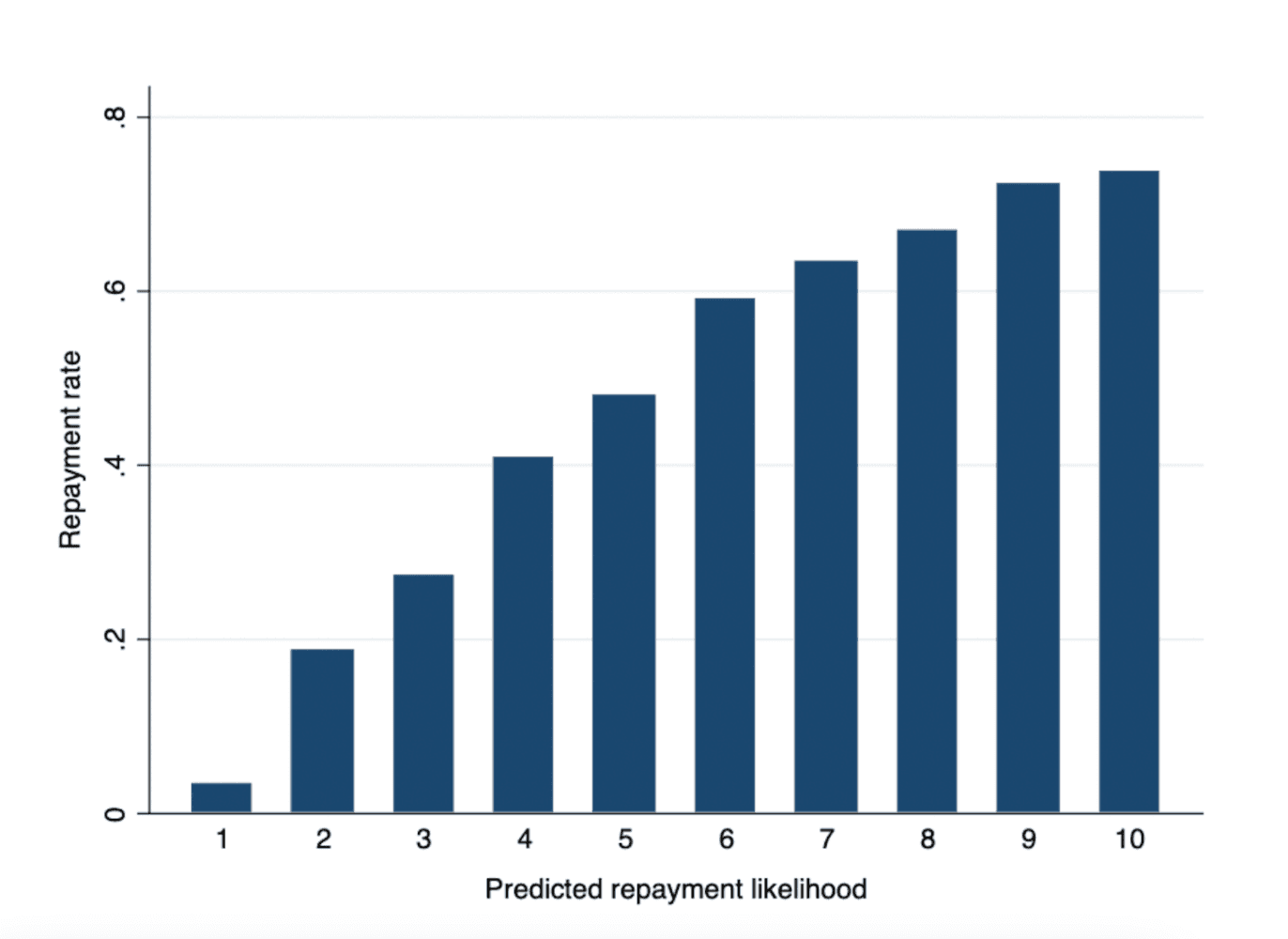

After identifying these signals, the model updated each agent's call list daily, ranking accounts by their likelihood to repay. This prioritization guided agents’ focus toward the most promising opportunities, enabling them to start each day with clearer direction and reducing the guesswork in their outreach.

Outcomes

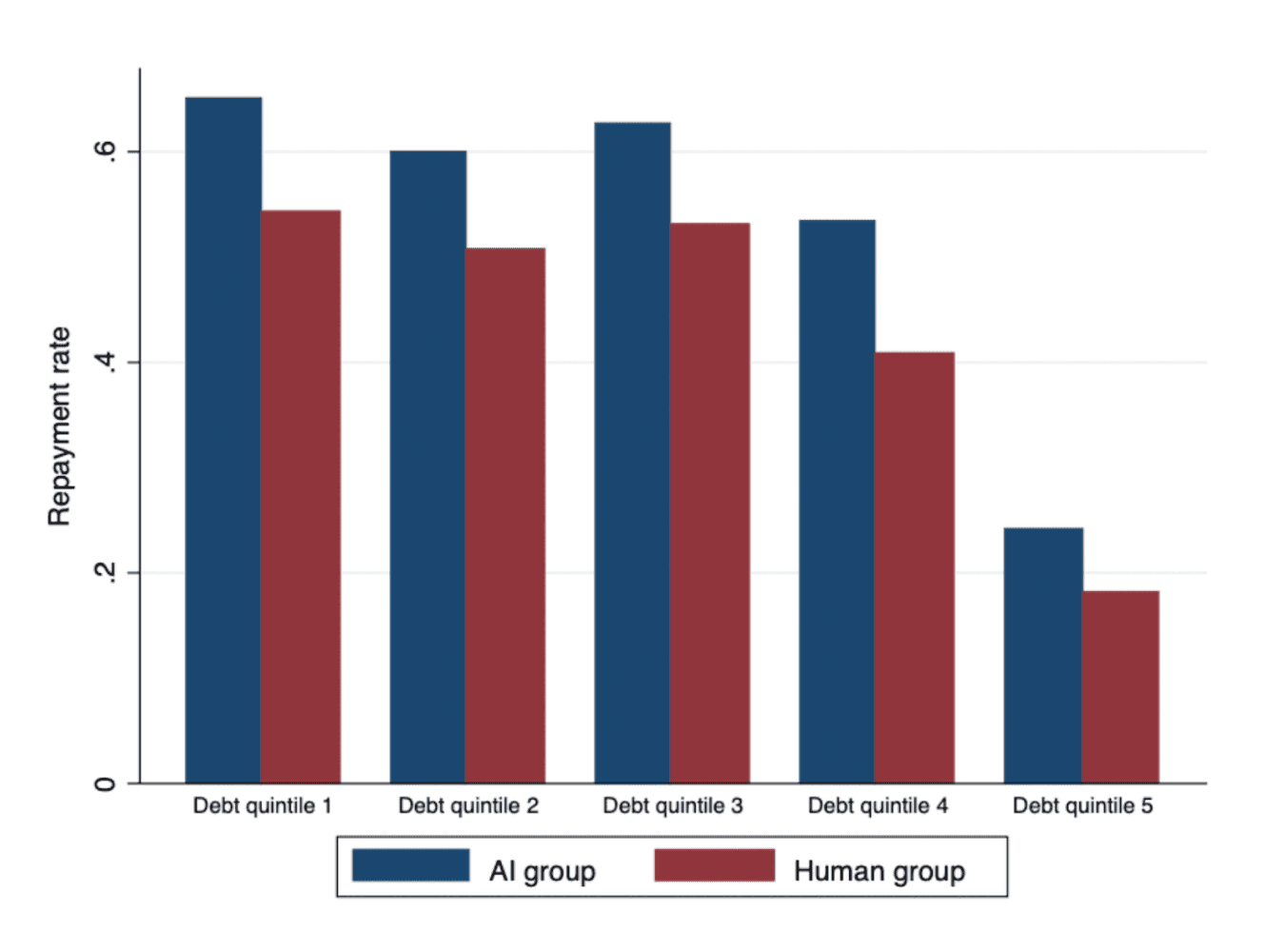

The study found that collectors using AI-generated call lists recovered significantly more debt while making fewer total calls. Repayment rates in the AI group rose by 23 percent, while overall call volume declined by 8 percent compared with the control group. See the figures below for more context.

Across 180 days, collection metrics for accounts in the AI group consistently outperformed the human-only group, achieving higher repayment rates earlier and comparatively improving throughout the period

Across every debt segment, grouped by the size of account balances, agents guided by AI-generated lists realized higher repayment rates than those relying on manual selection by officers

Why it Matters

According to the New York Federal Reserve, as of November 2025, U.S. household debt has surpassed $18 trillion, and about 4.5 percent of all balances are now delinquent. Specifically looking at credit cards, more than 14 percent of balances are past due. As consumers face greater financial strain, they need solutions tailored to them and their situation, not one-size-fits-all outreach strategies.

At the same time, industry consolidation and rising operating costs are putting pressure on margins. In this environment, operational efficiency and consumer sensitivity go hand-in-hand. The best performing agencies will be those that use intelligent scoring to tailor how and when they engage consumers in ways that increase the likelihood of repayment while optimizing the consumer experience.

What You Can Do About It

The study reinforces the value of continuously updated, behavior-driven scoring. Agencies that use models to prioritize accounts can recover more and reduce wasted efforts. Consumers benefitting from smart outreach are met with plans tailored to their situations, facilitating their path to financial success.

Fiber allows agencies to track outreach across every communication channel in real time. This fuels the accuracy and responsiveness of our AI offerings. By consolidating phone, SMS, email, and portal activity in one platform, Fiber provides richer data to improve scoring model accuracy and deliver best-in-class propensity-to-pay tools built for modern agencies.

To learn more about Fiber by Clerkie and how your agency can upgrade to the next generation of debt collection software, visit getfiber.ai.

Full Study: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4905228

Source New York Fed: https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/HHDC_2025Q3?utm